For Private capital

Perception made measurable – from due diligence to exit

Win With Perception Intelligence

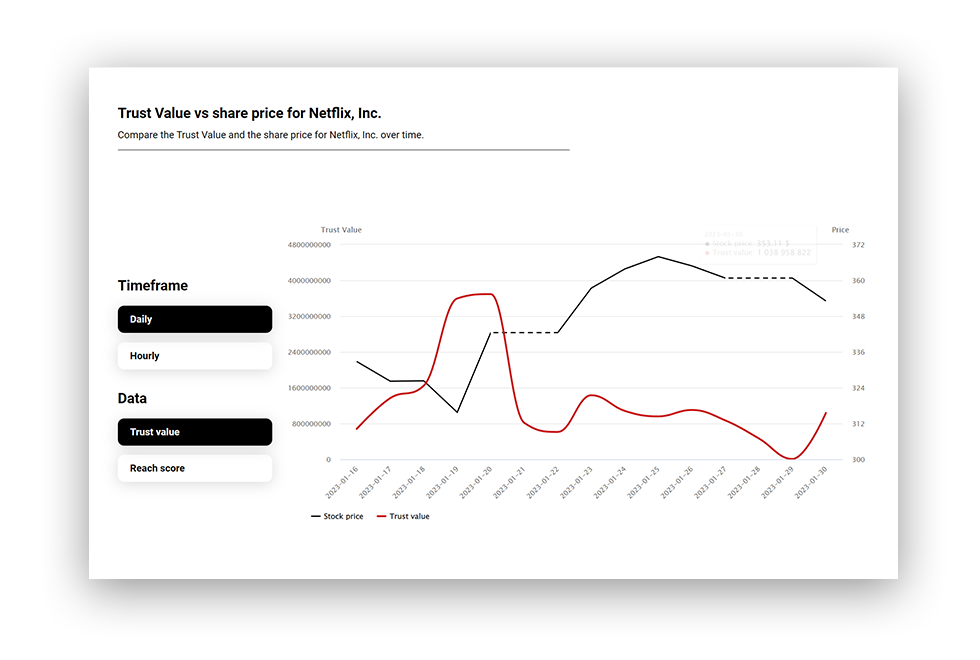

For private equity and venture capital, success depends on seeing what others miss. Reputation-driven risks and narrative value levers shape valuations long before they appear in financial disclosures. Atlastic empowers firms to act on these insights across the full deal cycle – before, during, and after an investment.

During due diligence, Atlastic data reveals hidden trust issues, reputational vulnerabilities, and stakeholder concerns that can affect pricing, negotiations, and regulatory exposure. After an investment, the same signals track trust, sentiment, and narrative momentum in real time – helping firms safeguard value, anticipate risks, and strengthen exit potential.

Atlastic transforms millions of verified global news signals into structured, predictive data, making perception a measurable dimension of private market performance.

Relevance in Private Capital

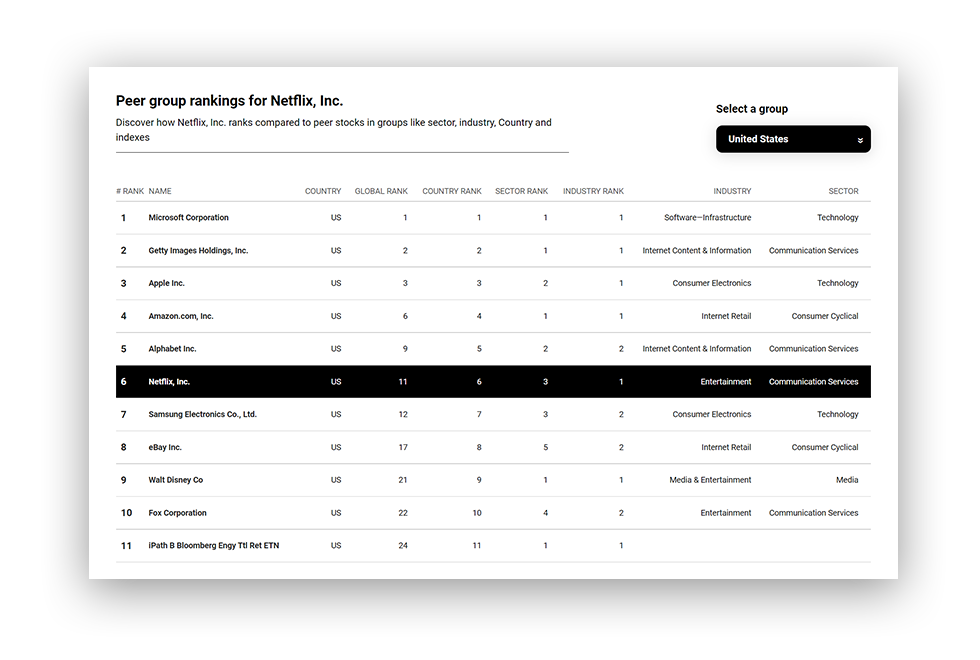

Private equity, venture, and infrastructure investors face mounting scrutiny from regulators, LPs, and the public. The intangible value drivers of a portfolio company – trust, reputation, ESG standing, and narrative positioning, can shift rapidly under the influence of media coverage, activist pressure, or unforeseen controversies.

Traditional due diligence relies on backward-looking reports, static questionnaires, and delayed stakeholder surveys. These methods fail to capture real-time shifts in perception, creating blind spots that can alter deal pricing, post-acquisition performance, or exit strategies.

Atlastic brings relevance to perception data, offering a forward-looking view of risks and opportunities. With structured, real-time intelligence, private capital investors can make better-informed decisions, protect reputational value, and unlock growth potential ahead of public markets.

A Methodology for Deeper Due Diligence

Atlastic is purpose-built to give private market investors scalable, high-precision insight into public narratives- complementing traditional due diligence and portfolio monitoring.

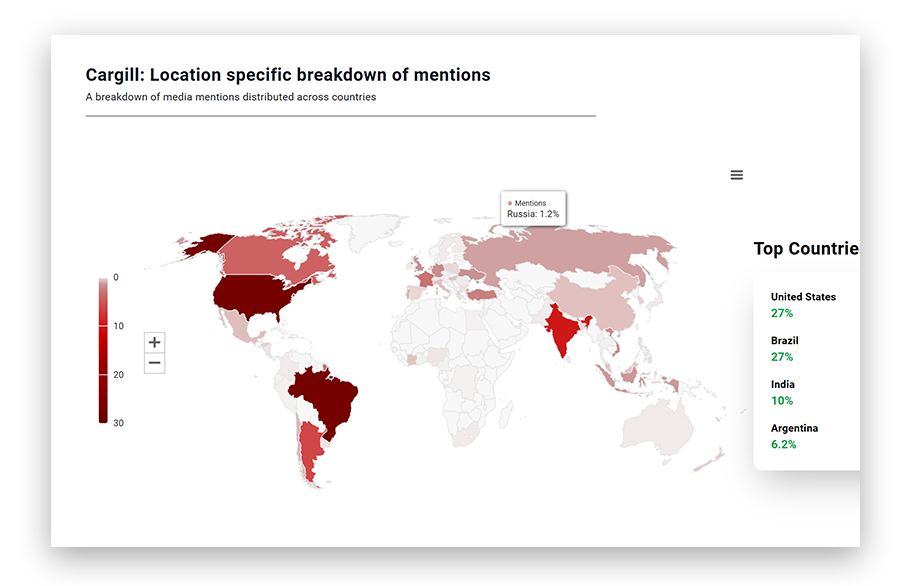

Our data pipeline processes over 4 million articles daily from 8.2 million verified sources across 100+ languages and 250+ jurisdictions. Coverage spans local and global media, NGO reports, regulatory filings, and industry publications—delivering a structured, research-grade view of perception risks and opportunities that traditional methods miss.

This data adds a predictive layer to the investment process, helping investors anticipate risks, validate value-creation plans, and manage stakeholder trust across the entire holding period.

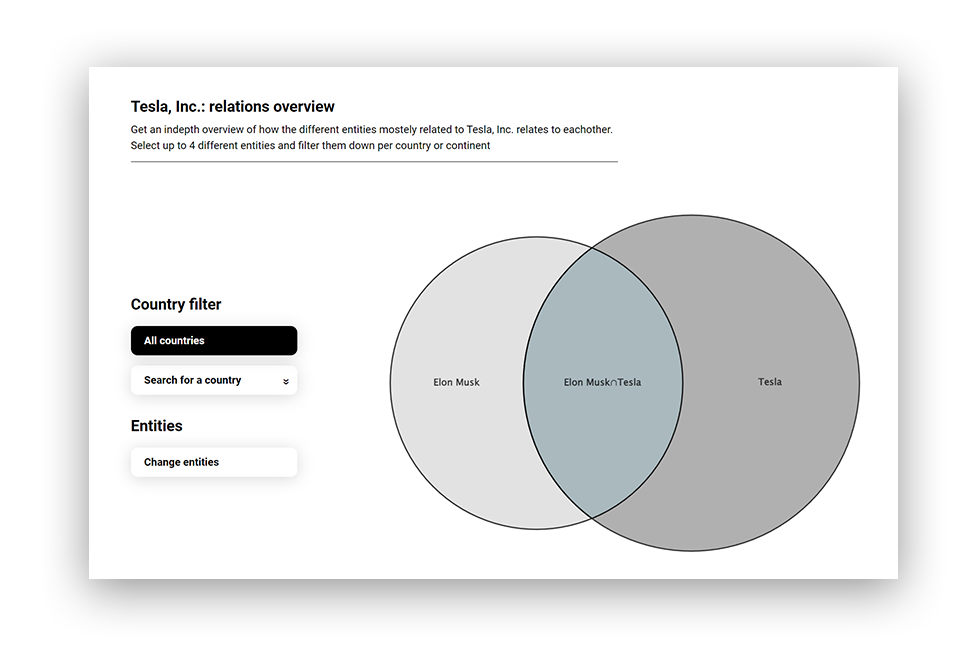

We go beyond basic sentiment tools to deliver:

- Narrative build-up detection: Spot controversies or trust erosion early, before they become headline risks

- Live ESG and reputation scoring: Quantify how portfolio companies, targets, and sectors are perceived across E, S, and G dimensions

- Contextual analysis: Understand issue framing and severity, not just positive or negative tone

- Source influence modeling: Prioritize high-impact narratives and key opinion drivers

- Visibility vs sentiment separation: Distinguish between how much attention a story gets and whether it builds or damages trust

- Bias correction: Ensure balanced global coverage across languages and markets

- Historical datasets: Backtest reputation and ESG perception patterns to refine deal screening and exit timing

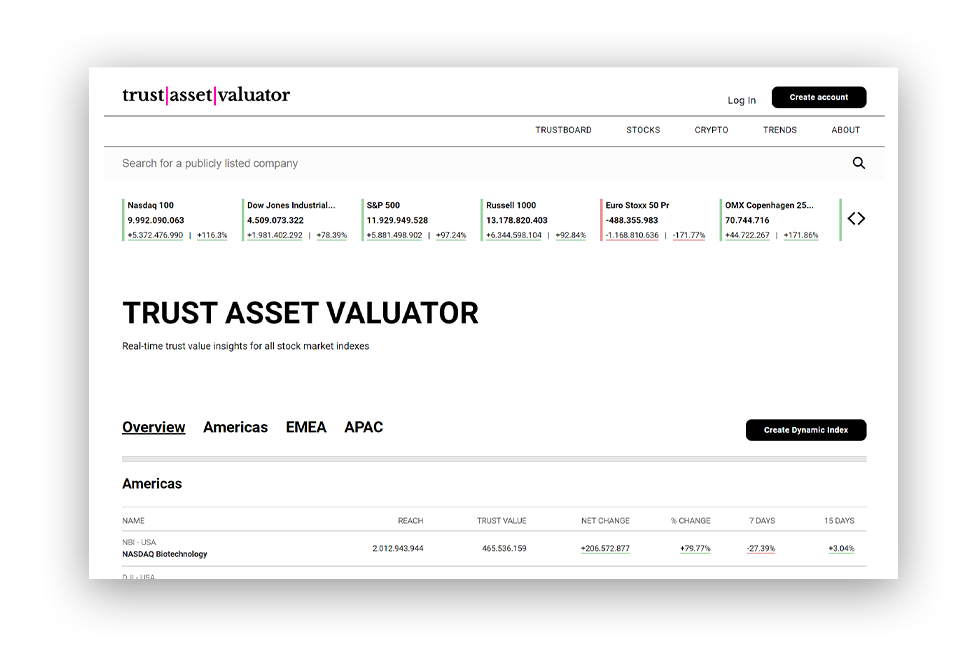

Intelligent Data Delivery

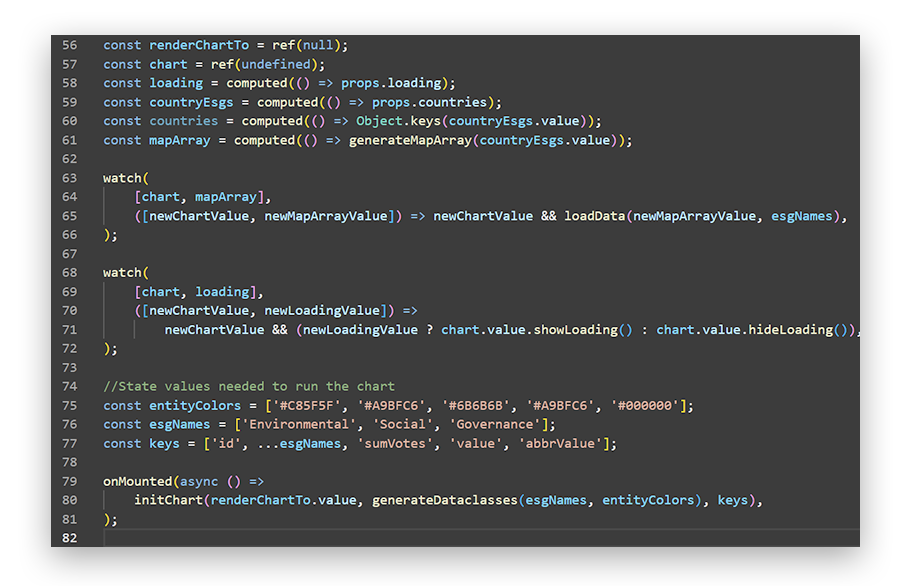

Atlastic delivers perception intelligence in formats built for both scale and accessibility. All data is fully structured for time-series analysis, hypothesis testing, and cross-asset comparison—ready to integrate directly into existing models, systems, and analytical workflows.

Delivery is available in two ways:

- Direct integration via API or custom feeds—clean, machine-readable, and investment-grade.

- An intuitive, no-code platform—giving teams instant access to advanced perception insights without requiring quant resources.

Built for scale. Designed for precision. Delivered with simplicity.

Explore how it works.

Request a demo to access sample data, explore perception mappings, and discuss how Atlastic fits into your existing quant research environment.